Tax information Networks Facilitation Centers ( TINFCs ) are appointed by National Depository Securities Limited ( NSDL) which has now been known as Protean to facilitate the e-governance Services to the general public in the field of Digital taxations like PAN Card, TAN, PAN Card Center, TDS and TCS preparation and uploading services.

Acute is one of few authorized Licensed Sales Partner to appoint PAN and TIN Facilitation Centre Branches in any part of the Country to render TIN Services to the masses under the supervision of NSDL and Its Licensed Authorities.

By the Virtue, Acute is in the Registered as Facilitators to Open TINFC Branch, UTI PSA, PAN Card Office in Mohali and have a core competency in Digital Signature Certificates, Tally Prime’s Sales, Services , Solutions and Customizations, GST Softwares , eTender , eBidding and GEM Services.

Applicants can get the PAN application form (Form 49A) and request a New PAN Card or/and Corrections or changes in PAN in the Standard format prescribed by the Income Tax Department (ITD) from TIN Facilitation Centres. Applicants have to follow through the instructions and guidelines mentioned within the forms before filling and submit to any Tax Information Network Facilitation Centres (TIN-FC). National Securities Depository Limited (NSDL) uploads the digitised PAN application data to Income Tax Department. Department issues PAN of respective applicant.NSDL prepares PAN cards and sends them along with a PAN allotment letter to the applicant.

Benefits of Opening the Direct PAN card office .

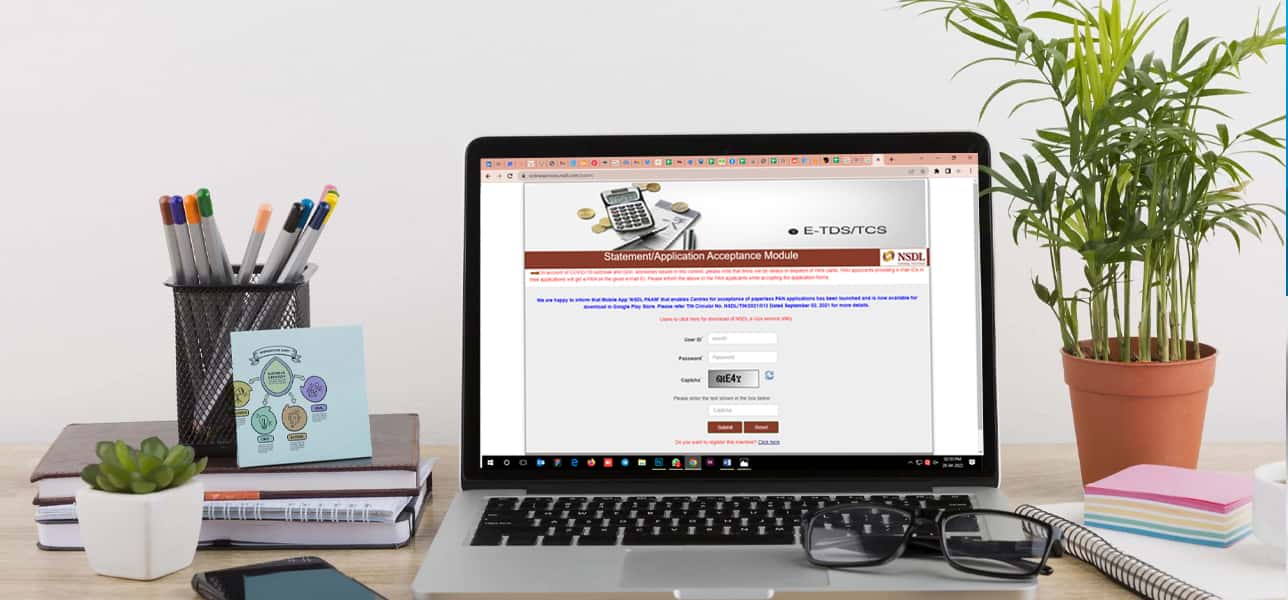

By Direct NSDL branch, you can get Direct Access to NSDL PAAM to issue the PAN Receipts and Check the PAN Status from your own PAN Portal.

TIN PAN Center can accept all type of PAN Applications like 49A, 49AA, Reprint and Correction of any type of category like individual, Firm, Trust, Society, Government, HUF, Body of Individual, Association of Persons, Firms etc.

Furthermore, in addition to the PAN Center, TINFCs can process and upload all type of TDS, 24Q, 26Q, TCS, 24G, AIR and Financial Transactions Statements.

Acute provides all handholding, Technical Support and Training to all the branches appointed by it under the stipulated compliances by NSDL.

Eligibility to get NSDL PAN and TIN Facilitation Center

To apply for TINFC PAN Center , the applicant must have to be eligible and qualified member of any of following Institutes

- • Securities and Exchange Board of India (SEBI)

- • Insurance Regulatory and Development Authority (IRDA)

- • Association of Mutual Funds in India (AMFI)

- • Member of Reserve Bank of India (RBI)

- • Direct Sales Partner of Any Certifying Authority to Sale Digital Signatures

- • Registered Cost Accountants

- • Chartered Accountants ( COP Holder )

- • Company Secretaries

- • TAX Bar Council of India ( Advocates )

- • Financial Consultants / Accounting and TAX Practitioners

- • Money transfer/ Bank Customer Service Points.

Process to apply For TINFC PAN card office

Acute is the Whole Sole Touch point to Process your Case File to get NSDL PAAM and Branch.

To Apply your PAN card office, we need below docs and requisite Payment deposit to process either PAN Center, TINFC Center or UTI PSA.

Eligibility certificate from the Above Qualifications

- - Application Form for PAN TINFC

- - Office Interior and Exterior Photographs

- - Verification Report by the Authority.

- - Undertaking on Letter Head by the Branch

- - Copy of Licensed Window and Antivirus.

- - Payment Invoice Copy

- - PAN Card and Aadhar card , Photo

- - Office Location Address Proof

- - Cancelled Cheque of the Bank