An income tax return is a form where taxpayers declare their taxable income, deductions, and tax payments. This procedure of filing income tax returns is referred to as income tax filing. While filing the ITR, the total income tax you owe to the government is also calculated. If you've paid more tax than needed for the financial year, the IT Department will refund the extra money to your account. If you have underpaid taxes for the year, please pay the remaining amount, and then file your income tax returns .

For ITR filing , you have to know the Income-tax Act, 1961 contains provisions for filing of return of income. Return of income is the format in which the assessee furnishes information as to his total income and tax payable. The particulars of income earned under different heads, gross total income.

- Avoid Tax Notices

- Avoid Scrutiny of IT

- Avoid penalties

- Refund of TDS

- Buying Life Cover Policy

- Hassle free loan processing

- Visa processing

- Processing credit card applications

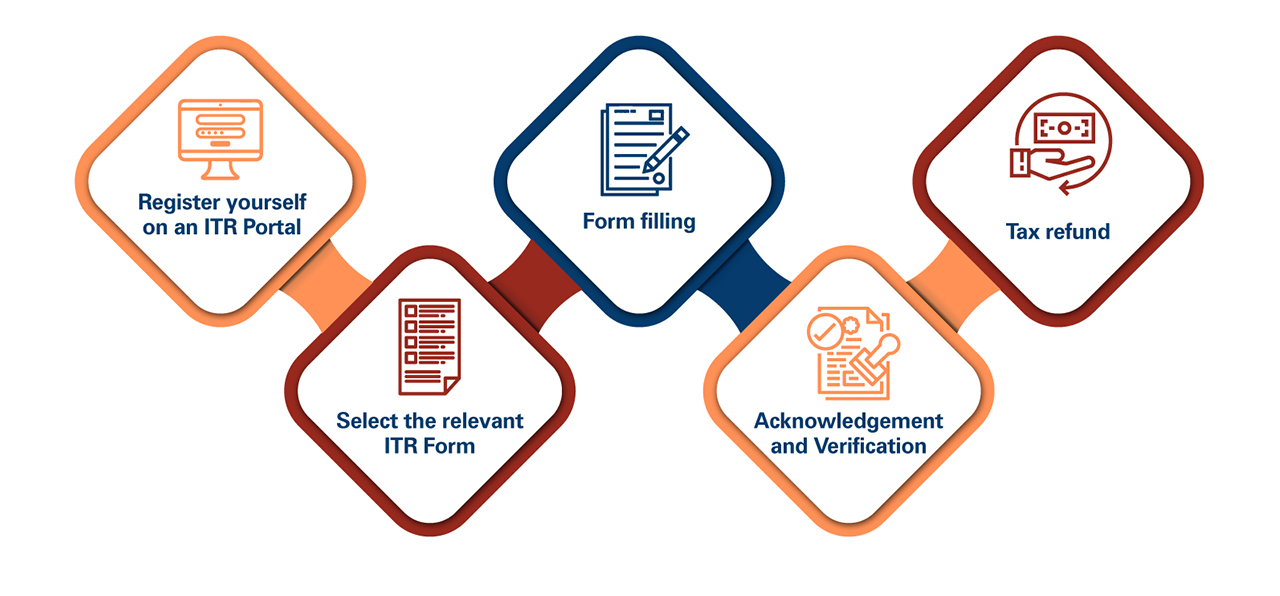

Every person, shall, on or before the due date, furnish a return of his income or the income of such other person during the previous year, in the prescribed 54 form and verified in the prescribed manner. It's a good practice to file or e-file your income tax return. An income tax return is an important document that you must produce at the time of availing a home loan, as it reflects your financial prosperity. An income tax return—as a proof of income—shows your capacity to repay a loan. Even a winner of “Kaun Banega Crorepati” has to file return of income. income tax return form ranges from ITR 1 to ITR 7, used for different types of income. Some income tax return forms are longer than the others, and they may need additional disclosures such balance sheet and a profit and loss statement information.